Hi There!

Hey there!

Happy New Year! It's the first proper business week of 2026, which means it's officially time to make some money moves.

(Iykyk. If you don't... Cardi B said it first, and she was right.)

And if you're filing taxes across multiple countries in 2026, your first money move is understanding what changed in the last year.

Quick heads up: If this newsletter looks different, that's because it is. We've been growing (thank you!) and upgrading things as we go. Think of it as a work in progress that's getting better with every send.

Now, onto the important stuff...

If you're filing taxes across multiple countries in 2026, I have news for you:

Your 2025 tax position is being calculated under completely different rules than 2024 was.

Recent regulatory changes from 2023-2025 are now being actively enforced across multiple jurisdictions. And they're live in your 2026 tax filings.

These aren't theoretical policy changes anymore. Enforcement is happening right now.

HMRC is processing affected returns. UAE tax authorities are collecting. DAC8 reporting has started.

This is Part 1 of 2: The 4 Rules That Changed.

Today we're covering what you need to know for your 2026 filings plus what to do in Q1 before deadlines hit.

(Part 2 drops Thursday. We'll cover the tools that actually make this manageable. Including Settel, which launches Feb 2nd.

The Big Picture: What’s Different in your 2026 Filing

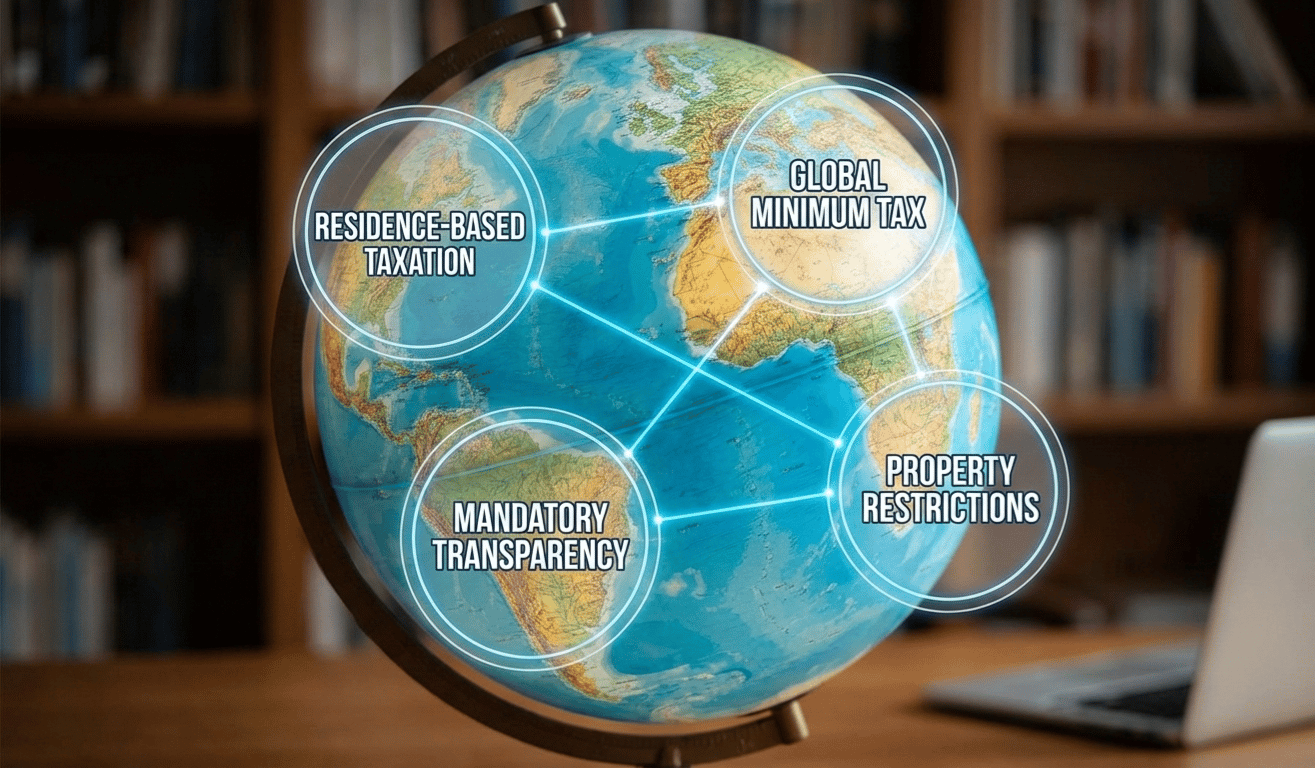

The 4 biggest changes affecting expat filings?

Residence-based taxation + global minimum tax + mandatory transparency + property restrictions

Translation: If you've been relying on "non-dom" status, zero-tax structures, or keeping assets off-radar, your 2026 filing is going to look very different from 2025.

Most tax software and advisors are still catching up. Let's break down exactly what changed, what it means for you, and what you need to do in Q1.

Change 1: Residence Is the New Domicile

Your Filing Status Just Got Simpler (But More Expensive)

✅ What works:

UK new arrivals can still claim 4-year foreign income exemption (if you qualify). Clearer rules reduce audit risk.

What changed:

The UK abolished its non-dom regime in April 2025. If you were UK resident for any part of 2025, your worldwide income is now in scope.

Australia strengthened residency test enforcement to catch long-term travellers under the 183-day rule. The US is moving toward residence-based proposals.

Impact: The "I'm not domiciled here" defense is dead. Now it's purely where you physically lived.

⚠️ Filing risks:

UK 10/20 rule is actively enforced (worldwide estate taxed at 40% IHT). Temporary Repatriation Facility closes April 2028 (12-15% vs. standard rates). If you were in a grey area before, expect scrutiny this filing season!

🤔 What to check:

• How many days was I resident in each country during 2025?

• Should I use the UK Temporary Repatriation Facility before the deadline?

Change 2: Global Minimum Tax Ended Zero-Tax Setups

Your UAE/GCC Entities Now Have Real Tax Bills

✅ What works:

With real substance (company actually does real business there, not just on paper), 9-15% remains competitive.

What changed:

The OECD (club of rich countries setting global tax rules) rolled out a 15% global minimum corporate tax starting 2024. The UAE introduced 9% corporate tax in 2023 (on profits above AED 375k/~$100k USD) plus 15% top-up for large multinationals.

Impact: If you set up a UAE entity to book profits at zero tax, those days are over.

⚠️ Filing risks:

UAE entities filing corporate tax returns for 2025. Shell companies (exist on paper, no real business) without substance getting challenged.

🤔 What to check:

Can I demonstrate real economic substance if challenged?

Change 3: Transparency Became Mandatory

Everything You Owned in 2025 Is Being Reported

✅ What works:

Full compliance means less scrutiny.

What changed:

The EU's DAC8 (Directive on Administrative Cooperation—Europe's system for automatically sharing financial info between countries) extends automatic information exchange to crypto, life insurance, and cross-border tax rulings.

FATCA (US law requiring foreign banks to report American accounts) and CRS (global version for 100+ countries) reporting continue expanding.

Impact: Tax authorities already have your 2025 data. Keeping anything off-radar is impossible now.

⚠️ Filing risks:

Crypto transactions from 2025 are already reported. Any discrepancies trigger automatic audits.

🤔 What to check:

Does my filing match what authorities already know from automatic reporting?

Change 4: Property Ownership Got Way More Expensive

Non-Resident Real Estate Just Hit Your Tax Bill Hard

What changed:

Canada implemented a non-resident property purchase ban (extended through January 2027), plus a 1% annual Underused Housing Tax (yearly tax for owning unused property). Toronto stacks 10% municipal surcharge on Ontario's 25% provincial tax (total: 35%).

India raised NRI capital gains tax (Non-Resident Indian tax on property sale profits) and excluded NRIs from indexation benefits (calculation that reduced tax by accounting for inflation).

Impact: That rental property you bought years ago? Your 2025 tax bill reflects these higher rates.

⚠️ Filing risks:

Canadian property: 1% annual tax due this year on 2025 holdings. Indian property sales taxed at higher CGT (Capital Gains Tax) rates without indexation.

🤔 What to check:

Does my after-tax yield still justify holding, or should I sell in 2026?

Where You Stand for 2026 Filing

These four changes fundamentally altered how your 2025 income, assets, and transactions are taxed. The old strategies? Gone, being audited, or now expensive.

But here's what most people don't realize: While governments were tightening rules, fintech was building the infrastructure to actually navigate this complexity.

Part 2 drops Thursday. We'll cover the 3 hacks that make 2026 filing season actually manageable.

🚀 And Speaking of Solutions...

Settel launches Feb 2nd. We built it specifically for this: helping you understand your multi-jurisdictional tax position globally with real numbers.

Want early access? Join the waitlist. Every referral moves you up 3 positions. 🚀

See you Thursday! 😊

Anita

Founder, Settel.io

P.S. Got questions about how these changes affect your specific 2026 filing? Hit reply. I actually read everything and I'm currently working on accuracy levels of the platform.